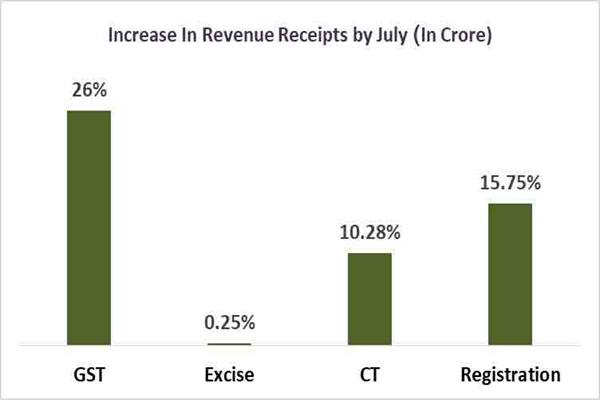

The transparent tax administration and the facilities provided to taxpayers and businesses men has led to increase in the Goods and Services Tax (GST) revenue collection by 26% till July compared to last year’s collection figure in the same period.

It was Rs. 8,311 crore which has increased to Rs. 10,945 crore this year, marking a 26 percent increase, while the collection target for July is Rs. 10,339 crore. Similarly, last year’s excise revenue collection until July was Rs. 4,643 crore, which has increased by Rs. 4,655 crore rupees this year. Following instructions of the Chief Minister Shivraj Singh Chouhan, the tax payers have been given all facilities.

The registration revenue has seen an increase by 15.75% compared to the previous year upto July. Last year, it was Rs. 2,732 crore, which has increased to Rs. 3,162 crore during the same period. The target of revenue collection is Rs. 3,085 crore.

Commercial tax revenue until July of the previous year was Rs. 21,571 crore, which has increased to Rs. 23,789 crore this year, representing an increase of 10.28 percent.

Till July of the financial year 2023-24, Rs 133 crore has been deposited by taking action in a total of 551 cases. As many as 863 cases are being audited. So far Rs 10.20 crore has been deposited. In the year 2023-24, Rs 37.20 crore has been deposited. Last year’s outstanding was 4895.16 crores. Out of this, Rs 1871.46 crore has been recovered. During the same period an amount of Rs 1011.12 crore was recovered. Recovery of Rs 5755.49 is under process.

Efforts are being made to make the tax administration more transparent and efficient. Notices related to audit, registration, verification, and other matters are being issued online through the GST portal. Officials have been directed to address taxpayers’ issues promptly.

Various provisions related to GST have been introduced, including renewed registration processes, scrutiny, audit, and quality control procedures to ensure smooth business operations. Concerning persons are being updated regularly about GST provisions and through WhatsApp-based systems and helpdesks.

Regular updates and announcements from the GST Council are communicated to the concerned. Representatives from industrial organizations, tax advisory groups, and chartered accountants are being consulted at regular intervals.

Under the Ease of Doing Business initiative, the process of registration has been simplified. In cases where the verification of the application for registration under the Madhya Pradesh VAT Act, 2002, and the Madhya Pradesh Entry Tax Act, 2002, cannot be completed within one working day, auto-approval provisions have been introduced to issue registration certificates after the completion of one working day.

For business with a turnover exceeding ₹10 crore under the Income Tax Act, the mandatory submitting of Form 4-E along with the audit report has been done away with and the audit report submitted under the Income Tax Act is accepted.

Certain provisions under the Madhya Pradesh VAT Act, 2002, the Motor Spirit Tax Act, 2018, and the High-Speed Diesel Tax Act, 2018, related to criminal offenses have been abolished.

Under the Madhya Pradesh VAT Act, 2002, petrol and diesel businesses are required to submit quarterly details. Additionally, stamp duty on sale deeds in favour of EWS owners issued by private developers under Rear Estate Regulatory Authority -registered projects has been waived.

To enhance business operations, provisions related to developer’s share in development agreements have been revised, reducing the stamp duty from 5% to ₹1,000.

Efforts are on to digitize registered documents of last 15 years, which is expected to be over very soon. The people will have access to old documents. Departmental application is being developed to further enhance transparency in property development, providing citizens easier access to e-stamping and e-registration services.